Why donate shares to Rainbow Trust?

Simple and tax-efficient, donating shares can help transform the lives of families with a seriously ill child with practical and emotional support when it matters most.

Every day, amazing people like you make our work possible. If you are considering donating shares, you’ll be helping families to cope when their world is falling apart.

What are the benefits of share giving to you?

If you donate to Rainbow Trust by giving shares

- You can claim full Income Tax relief on the value of shares

- No Capital Gains Tax will apply, so you can maximise your donations at no extra cost

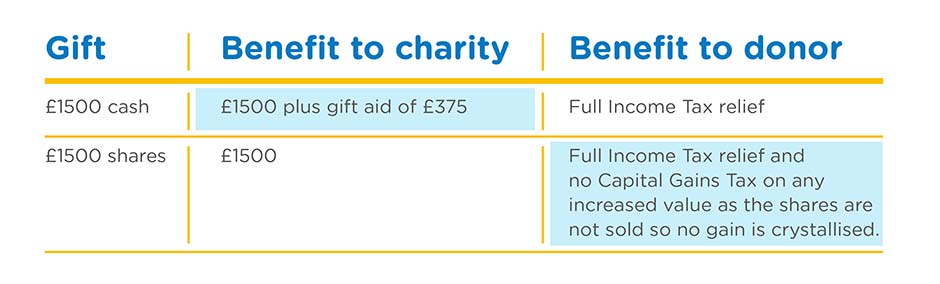

How does share giving compare to making a cash gift?